The Bitcoin-Gold Dichotomy: Unpacking the Myth of Safe-Haven

Is Bitcoin a safe-haven asset, or merely just a myth?

A Complex Reflection on Safe-Haven Assets

At first glance, the comparison between Bitcoin and gold seems straightforward. Both are finite in supply, both have seen their value increase significantly over time, and both are often viewed as alternatives to fiat currencies. But the deeper you dig, the more you realize that they are radically different in terms of behavior, underlying technology, purpose, and psychological impact on the markets. One could argue that Bitcoin, despite its potential, is not yet and may never fully embody the qualities of a traditional safe-haven asset like gold. Why? Well, let’s get into the finer details.

Historical Roots vs. Digital Genesis

First, gold has a history spanning millennia. Human societies have collectively ascribed value to gold long before organized economies even existed. Ancient Egyptians adorned their tombs with it; entire empires were built on its allure. Its appeal isn’t just cultural; it’s almost existential. There’s something about the rarity and malleability of gold that speaks to the human condition. It’s like an ancient code hardwired into us, connecting civilizations through thousands of years of trade, conflict, and expansion.

Bitcoin, on the other hand, was born out of cryptographic thought experiments and libertarian ideals in the wake of the 2008 financial crisis. Its pseudonymous creator, Satoshi Nakamoto, didn’t just develop Bitcoin to solve the problem of double-spending in digital currencies — he built it as a form of resistance. Bitcoin is as much a reaction to centralized control as it is a financial instrument. Gold represents continuity; Bitcoin is a rupture, a revolutionary rethinking of what “money” means.

And herein lies one fundamental difference in their nature as safe-havens: gold represents stability, whereas Bitcoin represents disruption. When the world is on fire, people typically flock to safety and stability, not to radical upheaval. Safe-haven assets are traditionally seen as anchors in turbulent seas. Bitcoin, despite its impressive rise, often feels more like the storm itself — a chaotic, volatile force that could sink or save your financial ship depending on the tides.

Volatility: The Heart of the Matter

Gold has always been known for its stability, particularly in times of crisis. It’s the thing you hold when fiat currencies devalue, when geopolitical uncertainty looms, or when inflation eats away at purchasing power. Sure, gold isn’t completely immune to volatility — no asset is — but historically, it has provided a store of value that remains relatively unscathed by the madness of the global economy. This is crucial for a safe-haven asset. You want something that retains value when everything else crumbles.

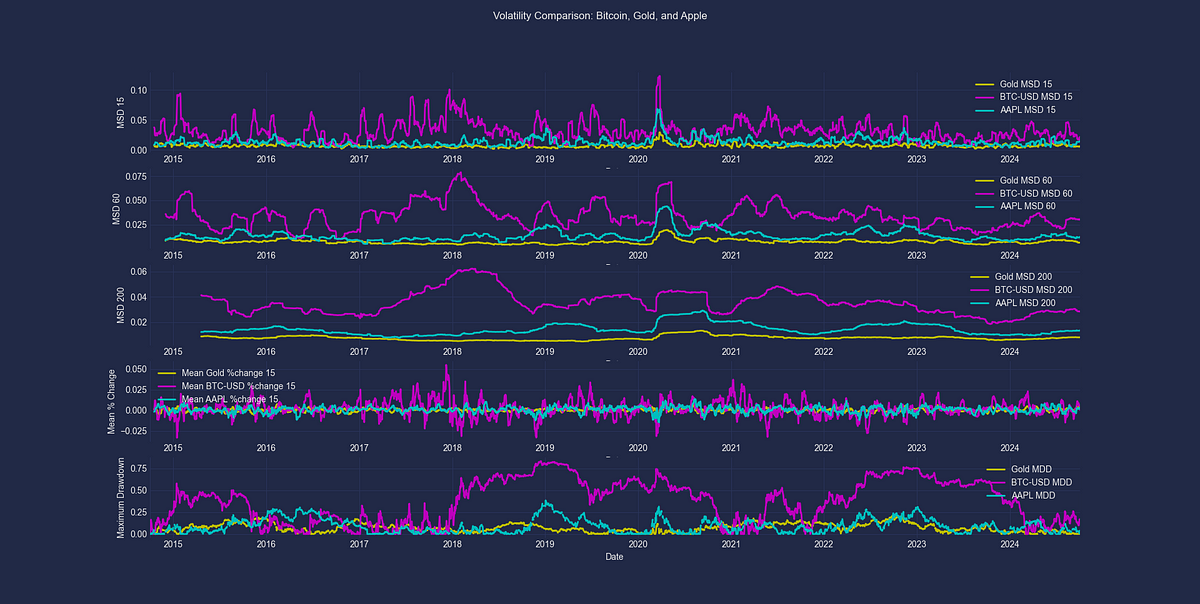

Now let’s look at Bitcoin. The very data you’re analyzing — historical price data, moving standard deviations (MSD), maximum drawdowns (MDD) — tells a story of violent swings. Bitcoin’s volatility is almost legendary. One day it’s up 10%, the next it’s down 15%. Hell, within the same day, you could see it move 20% in either direction. This isn’t just a risk asset; it’s a rollercoaster. And the maximum drawdowns are sobering. Gold might have its dips, but Bitcoin’s dips often feel more like plunges off a cliff, followed by a dizzying climb to new heights, and then another plunge. It’s not just volatile — it’s unpredictably volatile. And that fundamentally undermines its ability to function as a safe-haven in the traditional sense.

Let’s face it: when markets are in turmoil, the last thing most investors want is even more volatility. They want refuge, not risk. Bitcoin, with its wild fluctuations, doesn’t offer the kind of predictability or security that defines traditional safe-havens like gold. This doesn’t make Bitcoin any less valuable as an asset — far from it — but it makes it different. In fact, the high returns that Bitcoin offers often depend on that very volatility. It’s why early investors in Bitcoin could see 10,000% returns, but it’s also why you hear stories of people losing their life savings in a single, bad week.

Your code above visually demonstrates this volatility. The rolling standard deviations and maximum drawdowns of Bitcoin are notably higher than gold’s, reflecting that Bitcoin can soar to astonishing highs but at the risk of deep, sudden drops. These charts paint a picture of an asset that, while incredibly exciting, is inherently risky, not stable.

The Underlying Drivers of Value

What drives the value of gold? Well, it’s mostly two things: scarcity and its role as a hedge against economic instability. Central banks hold gold as part of their reserves, and it’s recognized globally as a store of value. Even when economies change — fiat currencies are born and die, political systems collapse — gold tends to hold its intrinsic worth. It is, after all, a tangible resource. You can hold it in your hand, lock it in a vault. Its very physicality gives it a sense of permanence.

Bitcoin is a different beast entirely. Its value is driven by factors that are still somewhat speculative: adoption, network effects, and belief in the system. Its scarcity is algorithmic (with a 21 million coin cap), but this scarcity is enforced by code, not by nature. It exists only in the digital realm. You can’t physically hold a Bitcoin; you hold a private key. And while this might not matter to younger, more tech-savvy generations, the lack of tangibility could be a sticking point for older, more conservative investors. The fact that Bitcoin’s value is largely driven by collective faith in its underlying technology and the potential for broader adoption is both its strength and its Achilles’ heel. Gold doesn’t need faith to function; it just is.

Moreover, while Bitcoin enthusiasts argue that its decentralized nature makes it immune to government manipulation, that same decentralization can be seen as a double-edged sword. Without central backing, without a physical form, and without centuries of historical precedent, Bitcoin’s value is much more precarious. When markets collapse, gold retains its value because of its inherent worth and long-standing role as a store of value. Bitcoin, however, is still proving itself in the face of crises.

Inflation Hedge: The Jury is Still Out

Gold is universally acknowledged as an inflation hedge. When currencies lose value due to inflation, gold often rises as investors seek a stable alternative. It has done so reliably over the centuries, making it a go-to for those worried about the long-term erosion of their wealth.

Bitcoin is often called an inflation hedge, but the evidence is mixed. The argument for Bitcoin as an inflation hedge is largely theoretical. The supply of Bitcoin is fixed — there will only ever be 21 million coins — and this scarcity could make it valuable in the face of an inflationary environment. But in reality, Bitcoin’s price doesn’t seem to consistently correlate with inflation in the same way gold does. In fact, its price often moves in tandem with risk assets like tech stocks, which typically suffer during inflationary periods.

The code you provided doesn’t directly compare these assets in an inflationary context, but it does highlight their different volatilities and returns over time. Bitcoin’s dramatic swings aren’t the kind of behavior you want when hedging against inflation. Inflation hedges are supposed to preserve purchasing power, not subject it to wild volatility. Again, this isn’t to say Bitcoin has no place in an inflationary world, but it’s still unproven as a reliable hedge in the way gold has been over centuries.

Psychological and Sociocultural Perceptions

Beyond the economics, let’s talk psychology. When people are afraid — when markets crash, when war breaks out, when economies falter — they tend to flee to safety. Safe-haven assets aren’t just financial tools; they are psychological salves. Gold fits this role perfectly. It’s hard to argue with thousands of years of human behavior. People feel safe with gold.

Bitcoin, however, is still a relatively new player. Its perception as a “safe” asset is mostly championed by tech-savvy investors, early adopters, and those ideologically aligned with decentralization. But the broader public still associates Bitcoin with risk. When the next financial crisis hits, will the average person buy Bitcoin as a refuge? Or will they, as history suggests, turn to more tangible, stable assets like gold?

This isn’t just conjecture. We’ve seen it already. During periods of market stress, Bitcoin often declines alongside equities, while gold remains stable or even appreciates. This correlation with risk assets suggests that Bitcoin isn’t yet perceived as a safe-haven by the majority of investors.

Conclusion: Bitcoin Is Not the New Gold

In conclusion, Bitcoin and gold are fundamentally different. Gold’s value as a safe-haven asset is rooted in centuries of human behavior, its physical properties, and its stability in times of crisis. Bitcoin, while offering incredible potential for returns and representing a new frontier in digital finance, lacks the stability and historical precedent to be a true safe-haven in the traditional sense. It’s an exciting, volatile, revolutionary asset, but for now, it’s more akin to a high-risk, high-reward investment than a safe harbor in turbulent financial waters.

So, the next time someone says Bitcoin is the “new gold,” remind them: they’re both valuable, but they serve fundamentally different roles in a portfolio, especially when the world is in chaos.

In the words of Warren Buffett, ‘Price is what you pay. Value is what you get.’ When it comes to safe-haven assets, investors should prioritize value over price, and gold’s enduring allure lies in its intrinsic value, scarcity, and reliability, making it a superior choice to Bitcoin for those seeking a trustworthy store of value.”

Leave a Reply